When you buy your first home, you are going to have a lot of expenses that you may or may not be aware of going into the house purchase. You may think you’re just buying a house, but that’s not all. Whether it’s utility bills, the monthly payment or interest payment on your mortgage, or crucial renovations like window sealing, there’s a lot that goes into getting your new home ready for you and your family. Here are 10 of the most common expenses that you need to be prepared for when buying a new home.

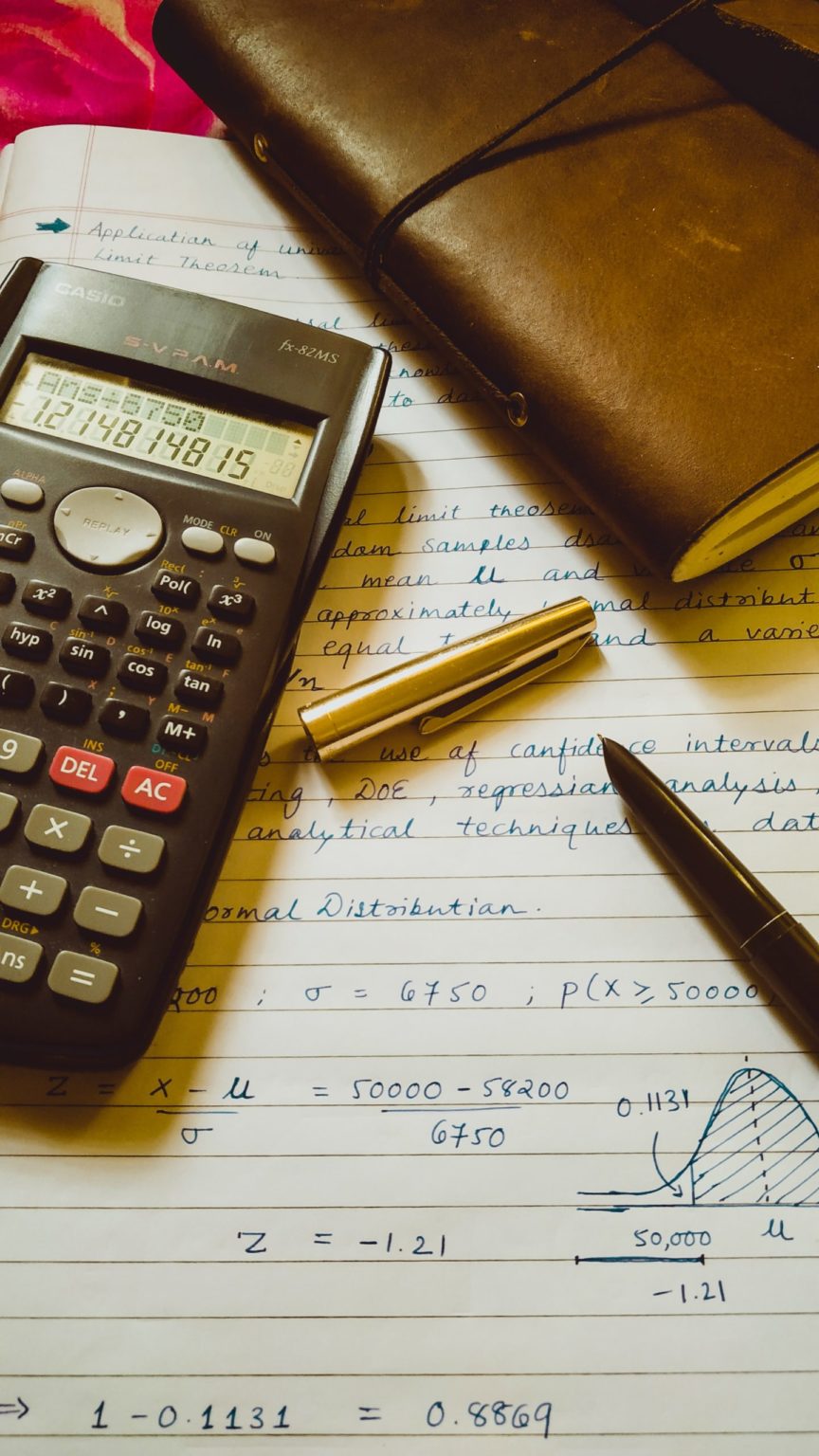

1. Interest

When you get a mortgage loan, your lender will charge you interest based on the total loan amount. While your loan amount is based on your down payment and your credit score, the interest rate will be based on factors like the selling price of the house, your credit score, and the current interest rates. You can get a fixed-rate loan, which means the interest rate will stay the same for the life of the loan, or you can get a variable-rate loan, which means the interest rate will change over the life of the loan based on changes in the market. Fixed home loan rates are generally safer because you will always know exactly what your monthly mortgage payment is going to be. If you get an adjustable-rate mortgage and the interest rates to increase significantly, your monthly payment may go higher than you can afford. Mortgage loans are a big step, so make sure you decide whether you want an adjustable-rate mortgage or a fixed-rate mortgage before you make the first down payment.

2. Taxes

The taxes you may owe on your new house will be based on the house’s size, the value based on a local tax assessment, and the local tax rates. Each community determines what their taxes will be based on what homeowners agree to pay for the city, the schools, the libraries, the parks, and other facilities and services funded through local tax dollars.

3. Insurance

When you buy a house, you are required to carry homeowner’s insurance. You can get it set up so that the insurance is included in your monthly mortgage payment, so you do not need to worry about paying an additional bill each month. Depending on where you live, you may need additional insurance like flood insurance or hail insurance.

4. Roof Repairs

The roof is a significant part of the house because it protects the entire house and your belongings from the elements. Therefore, it is critical to ensure the roof is always in good condition, repairs are made quickly, and the roof is replaced before problems damage your home. Roof repairs can be expensive, so have professionals asses your roof before you pay a down payment on your home. This may be a major part of your budget, so you should definitely plan for it and be prepared.

5. Foundation

Similarly to the roof, the foundation is critical to your house’s safety and the protection of you and your family. If the foundation is cracked, settling, or having other problems, your entire house could start to crack and crumble. If you discover foundation problems, they are vital to get fixed as soon as possible, regardless of the cost.

6. Windows and Doors

Windows and doors are critical because they provide movement in and out of your house, they provide security, and they help maintain the house’s temperature. Old doors and windows will cause your utility bills to increase as your furnace and air conditioning needs to work harder to maintain the house’s set temperature. If you are losing money because of your doors and windows, you need to look into window replacement as soon as possible. You’d be surprised how much heat can escape through a poorly sealed patio door, and how much new windows can save you on your electric bills. Start by searching for professionals in your area. For example, you can search windows in Traverse City online to find a new window installation company in your area.

7. Utilities

Monthly utilities will include your gas, electric, water, and phone or internet. While you have some control over these expenses, the only one you can choose to live without is the phone or the internet. If you have an all-electric house, you won’t have a gas bill, but your electric bill will be higher, so you are still spending the money each month. This is where having new windows and well-sealed doors can impact your electric bill spending and give you the peace of mind that comes with knowing you aren’t wasting money.

8. Lawncare

Whether you do your own lawn care or air it out, you have to take care of the property. Once you buy a house, That may include buying a lawnmower, weed wacker, rakes, shovels, and other lawn tools you likely didn’t own if this is your first house. Doing a great job on lawn care will make you proud of your property and even enjoy it more!

9. Appliances

Appliances can be expensive to buy or repair, but you can’t live without them, so they create one of your most common expenses as a homeowner. The appliances include the refrigerator, stove, dishwasher, washer, dryer, microwave, and deep freezer. While you can survive without many of them, a refrigerator and stove are must-haves.

10. Cleaning

Similarly to lawn care, whether you hire a cleaning service or clean your new home, you will be regularly spending money. You will need cleaning supplies, a mop, bucket, broom, vacuum, rags, and brushes in addition to cleaning chemicals, sprays, and soaps.